Swissploitation?

Copper is one of those unsung workhorses behind the wonders of the modern world. Its in the printed circuit board of your smart phone, in the wiring and plumbing embedded in the walls of your house, anywhere there is a motor or turbine whirring, from the biggest powerstation to the fan that stops your computer overheating there are coils of copper involved.

You probably knew that. But I bet you have no idea what the price of kilo copper is.

Its another one of those wonders that you don’t have to. Somewhere around the world people are digging up ore, refining it and processing it into wires and sheets, trading it and shipping it, without the people who benefit having the faintest idea what the price is.

But all too often, though, the countries where metals and minerals are mined receive too little for their natural resources, or the revenues that they do earn are not stewarded by governments for the benefit of their people, but are captured through secret contracts and unreported payments, and hidden away in offshore bank accounts.

Alex Cobham at the Centre for Global Development says that this happened spectacularly in Zambia in 2008, through the involvement of Swiss commodities traders – He gives the startling statistic that

“if Zambia had received the price for its copper that Switzerland declared on re-exporting the exact same copper, then Zambia’s GDP would have nearly doubled; the economic impact if we are able to sort out trade prices is potentially enormous”

When I first heard this story, I thought ‘that is absolutely terrible’, but the more I saw the statistic quoted and the more I thought about it, something bugged me – Zambia is a major copper exporter, and Switzerland is a major trader: why didn’t anybody notice?

You and I may have no idea what the price of copper is, but there are people who make a living from dealing in the stuff (and they are not all in Switzerland). Why did other sellers of copper not notice that Swiss traders had customers apparently willing to pay such high prices? Why did these customers not notice that they could get a better deal elsewhere? Why did the high prices that Cobham noticed not show up in Platts, or the London Metals Exchange, or the graphs of World Bank?

The startling finding comes from research that Alex Cobham did at Christian Aid. The methodology is explained in the ‘Blowing the Whistle’ report. And the same core approach has been used by CGD in a recent ‘Forensic Analysis’ to estimate ‘Swiss-ploitation’; illicit flows across all developing countries trading with Switzerland.

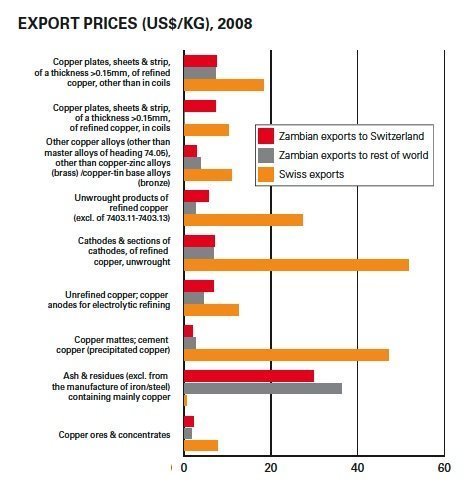

The methodology uses international trade statistics and compares the prices that Zambia receives for different types of copper, with the price that the same commodities apparently fetch (albeit in much smaller quantities) when exported from Switzerland. As the Christian Aid report explains;

“While Zambia’s prices are close to world averages … the Swiss prices are much higher. Were Zambia to receive Swiss export prices for its exports to Switzerland, the total value received would in 2008 have been almost six times higher than it was, adding some US$11.4bn to Zambia’s GDP, which in 2008 was just US$14.3bn in total.”

The idea that Zambia could almost double its GDP just like that, seems astounding – too good to be true. And a lot of this promise rides on those Swiss reported prices being good indicators of the true price realised on sales of much larger volumes of copper .

Even if you have no idea what the price of copper is, it seems hard to believe. In fact often in the telling of it the story it is misinterpreted into something which sounds more credible – Maybe Swiss companies were buying Zambian copper at cut price through shady deals or transfer pricing, and then selling it on at world prices to shift profits?

| Misunderstandings? Owen Barder at CGD told Fast Company that “if Zambia were selling its copper at world market prices, instead of laundering it through Switzerland to take the profits off-shore, Zambia’s GDP would be 50% higher. Lawrence Macdonald at CGD relates “What seems to have been happening is this…A Zambian company, or a Zambian subsidiary of a Swiss company, sells the copper it mines to a Swiss-registered company at prices greatly below the market value. The Swiss-registered company then resells the same copper at world prices (and in some cases declares a price far above the world price), taking the difference as profit in low-tax Switzerland, and in the process depriving Zambia of both export earnings and tax revenue on the sale” |

Just to be clear, this is not what the calculation of Zambia’s lost GDP says – it says that Swiss traders were buying at close to world price and selling at six times higher – for example copper cathode at around $50 per kg, and copper ore at $8 per kg.

Tracking of world copper cathode prices by the World Bank over the past ten years, shows prices that peak at under 10 $/kg. Yet Christian Aid and CGD say that Zambia should have been getting $50.

I got into conversation about this with Alex Cobham and Owen Barder on Twitter, and by email, to try to understand how they could be so confident in such a strange assertion , but after going round in a few circles I was left none the wiser. I considered asking Christian Aid, but last time I asked to see research data, they told me that I would need a good reason, and wanting to understand the basis of the research was not a good enough reason.

So, being a gal who knows how to have a good time, I went to the UN COMTRADE database (the source of the data for both the Christian Aid report, and the wider CGD study) and downloaded the 2008 Zambia to Switzerland export figures and the Swiss copper exports. What I found out shocked me (…here is the data...).

The largest category of copper exports from Zambia reported as consigned to Switzerland is ‘copper cathode’. 214 million kilos of the stuff in 2008. I reckon that’s about 1,400 standard sized shipping container loads. Most of it doesn’t actually go to Switzerland, but directly to Dubai, or China or wherever (it is impossible to tell this from the UN figures).

According to the Christian Aid/CGD methodology the true value of Zambian copper cathode was 51 $/kg (…why did no one notice….?) and therefore the Swiss traders conned Zambia out of $9.6 billion which it should rightfully have earned.

So how much copper cathode was exported from Switzerland at an average price of $51, to reveal this to be the ‘true value’?

The answer is 1909 kilogrammes.

Copper cathode comes in sheets of around 1 m square and 1 cm thick. They weigh around 125kg each. So the total Swiss exports over a year amounted to 15 sheets (in three separate shipments). The whole lot would fit under my desk, or in the back of my car. There are suppliers on Alibaba offering 1 tonne of copper cathode as a free sample and generally they require a minimum order size of 20 tonnes.

1909kg is not just a relatively small quantity, compared to Zambian exports, it is an objectively tiny amount!

I looked up the next category down. Copper Ore. Here the Christian Aid/CGD ‘true value’ was $7.60 $/kg and the imputed illicit capital loss to Zambia was $1.1 billion. So how much data was that figure based on?

In 2008 Switzerland reported exports of copper ore came to a grand total of 10kg.

That’s a shoe box full.

These two categories make up 93% of the overall total of ‘Zambia’s lost GDP’.

Seriously?!?

So what about the price? My guess is that these were simply not commercial shipments. They might have been product samples, or displays for a trade exhibition, or scientific samples being sent between labs, who knows. Probably whoever wrote out the customs tag on the FedEx label had as little idea of the price of copper as you or I, so they just wrote down a round number.

The idea that you can look at these few datapoints on non-commercial sized shipments and present this as a ‘forensic analysis’ that reveals billions of dollars of global fraud and market fixing is frankly ridiculous.

And yet this is what CGD (an organisation with tonnes of credibility, that does really good research) has done, in a much bigger study which gives a headline of $120 billion in potential illicit flows to Switzerland each year. (I have not been able to look at the data, but it uses the same core methodology as Christian Aid for all but its most conservative estimate, so I’m not hopeful).

Why did no one notice?

If I am right about these figures, it leads to the question why did no one else notice that the big numbers were built out of such silly calculations?

Maybe someone did, but didn’t say anything because they didn’t want to create doubt around a number that had become a key talking point in the argument for transparency. Maybe no one said anything because it would be seen as defending the ‘wrong ‘uns’. Maybe no one said anything because it feels a bit mean.

Ultimately no one said anything because the fact that the methodology calculates $1 billion of illicit flows on the basis of the price declared on a single $10kg shipment was simply not disclosed in either the Christian Aid or CGD reports. Perhaps it was even forgotten.

Does it matter?

I think it does. I think that CGD is a great organisation and I was glad that they had become involved in research and debate on illicit flows. Some of the big numbers (like $160 billion ‘Death and Taxes number) that have driven awareness so far need to be retired and replaced by a next generation of analysis, in support of evidence-based-policy. I hoped (and still hope) they would bring a more nuanced and open analysis to this area.

It matters because effective transparency depends not only on there being raw data in the public domain, but on that data being made meaningful by research organisations, NGOs, the media and other opinion formers – most people are never going to look up tables of numbers from places like COMTRADE, so we rely on organisations not to take advantage of our trust .

It matters specifically in relation to the issue of commodities and development, because transparency really matters here.

There is a horrible dynamic in negotiations between extractive industry companies and governments in countries that don’t have a strong history of stability and good governance. Companies contemplating big sunk investments, but fearing that deals are vulnerable to be renegotiated, or assets nationalised by future regimes use all their economic and technical power to strike a hard bargain in the first place. But hard bargains that fail to deliver broad local economic benefits and provide resource rents for the public good only lay the ground for escalating disputes which undermine the very political stability that long term investment needs.

Transparency offers a potential solution to help break out of this prisoners dilemma, through open contracts, and extractive revenue transparency, enabling people and organisations to monitor and hold to account both government and companies (but only if the organisations that analyse and help people understand the data do it with scrupulous robustness).

Doubtless there are unscrupulous operators and sharp practices. Trust is hard won and easy to destroy. Exposing wrong-doing requires real forensic analysis.

Supporting an open and well informed public debate on whether a fair share of rents and profits is being returned to a country requires serious and honest presentation of findings from complex data.

Filed under: Uncategorized | 10 Comments

A lovely, lovely piece of digging there. As one of the few people who would know what the price of copper is (call it $8 a kg among friends) the idea that Switzerland has been selling commercial quantities at $50 is absurd. Samples, as you say, maybe. Or very small lots even (don’t forget that customs prices must include transport costs. So if someone sends one cathode by Fed Ex that will show up as a v. high price per kg).

It astonishes me that CGD (and especially Owen) are trying to stand by this work still.

Thank you Maya for taking the time to think about this and to set our your criticisms of our approach. I’ll post a longer response on the CGD blog setting out my thoughts about what you say here; but in short, I accept the central point and plan to revise the paper.

Alex Cobham has posted a response here

He says that they are going to revise the analysis and the paper.

Kudos to Alex, Owen and the CGD team for responding with seriousness and integrity.

Reblogged this on Gabriel Pollen and commented:

Fantastic thoughts on Copper invoicing; a complement to the ‘misinvoicing or misundersting’ article…